IPO

Urban Company Files INR 1,900 Cr IPO

The issue will open on September 10 and close on September 12, with shares to be listed on both the BSE and NSE.

Tata Capital Targets ₹17,000 Cr, OYO Plans $7-8 Bn Listing

Tata Capital is aiming to raise INR 17,000 crore through its upcoming public issue, as per its updated draft red herring prospectus (UDRHP), while hospitality major OYO is expected to file its Draft Red Herring Prospectus (DRHP) in November, with a target valuation of USD 7-8 billion, according to sources cited by PTI.

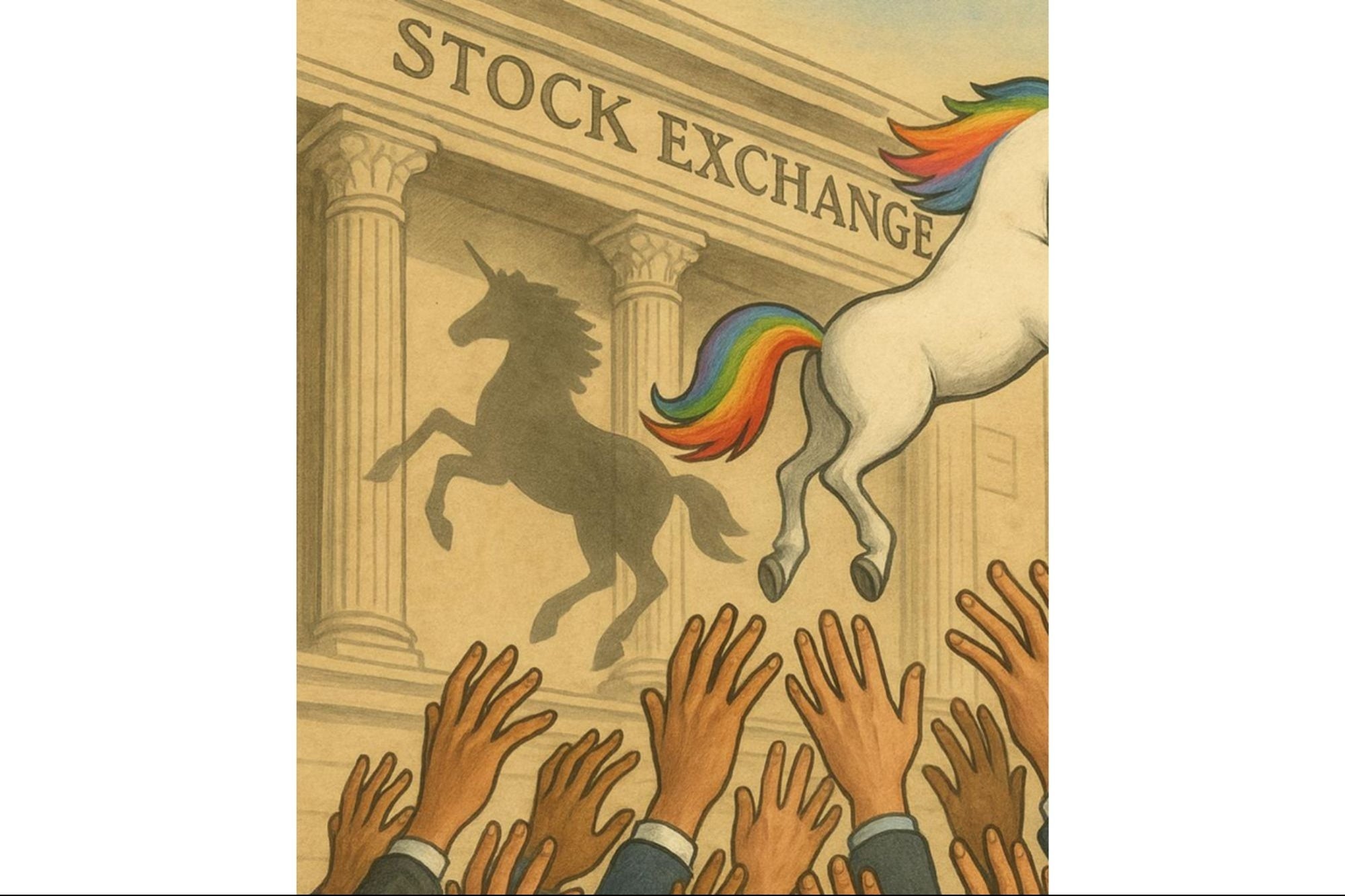

Hunting the Next Pre‑IPO Unicorn: Why Everyone Is Trying to Catch the World TradeX Rocket Before It Leaves the Station

Among the slate of highly anticipated pre-IPO unicorns—Figma, CoreWeave, Dexterity, Pony.ai, and Linqto—one name stands apart, largely because almost no one outside of deep-pocketed insiders had even heard of it until recently: World TradeX.

More Companies Are Choosing to Stay Private — But This One Big Issue Could Derail Their Success

As the private marketplace continues to grow, there needs to be more clarity around how private company shares are valued and how share classes are structured.

Reform Hopes Power IPOs with Market Optimism Around GST Reforms

The Indian IPO market is on an uptick mainly due to positive sentiment, strengthened by expectations of reform announcements ahead of Diwali, reinforcing the ongoing relief rally, with analysts highlighting that the market's gap-up opening earlier in the week signaled strong investor confidence in the uptrend.

Kissht Operator OnEMI Technology Files DRHP for INR 1,000 Cr IPO

OnEMI Technology aims to allocate INR 750 crore from its fresh issue to strengthen subsidiary Si Creva's capital base and may also explore an INR 200 crore pre-IPO placement.

Fractal Analytics Files ₹4,900-Crore IPO; Plans Global AI Expansion

The Initial Public Offering (IPO) will consist of a fresh issue of equity shares aggregating up to INR 12,793 million and an Offer for Sale (OFS) of equity shares aggregating up to INR 36,207 million.

JSW Cement IPO Receives Strong Response, NSDL Delivers Stellar Returns

JSW Cement IPO allotment on August 12, listing scheduled for August 14, while NSDL Shares deliver 78 per cent IPO Returns; stock extends winning streak.

NSDL Makes Strong Market Debut with 17% Listing Gains

NSDL has now become the second depository services provider to be listed on Indian exchanges, following Central Depository Services Ltd. (CDSL), which has been publicly traded since 2017.

Tata Capital Files for IPO to Raise Funds Amid Regulatory Push

Tata Sons-backed Tata Capital has filed draft papers with the Securities and Exchange Board of India (SEBI) for its highly anticipated initial public offering (IPO), marking a significant step towards meeting regulatory obligations and future growth.

Aditya Infotech Soars with 100x Demand, NSDL Gets 25.68x, Laxmi India Finance Sees Steady Retail Backing

Aditya Infotech's INR 1,300 crore IPO saw exceptional demand with over 100x subscription, while NSDL's INR 4,011 crore issue clocked 25.68x bids by Day 2, driven by strong QIB and NII participation. Laxmi India Finance closed with a modest 1.85x subscription, led by retail investors and long-term interest.

Lenskart Files Draft Papers for INR 2,150 Cr IPO

The eyewear retailer will use IPO proceeds for new store openings, lease and license payments, technology and cloud upgrades, marketing, potential acquisitions, and general corporate expenses to expand operations and strengthen its presence across India.

Laxmi India Finance, NSDL & Aditya Infotech to Go Public This Week

Laxmi India Finance, NSDL, and Aditya Infotech are launching their IPOs in the last week of July 2025, collectively aiming to raise over ₹5,500 crore. While Laxmi India Finance and Aditya Infotech will use proceeds for business growth and debt repayment, NSDL's issue is a pure offer for sale.

IndiQube IPO Subscribed 3x on Day 3; GMP Slips Despite Retail Buzz

The INR 700 crore initial public offering received bids for more than 5.37 crore shares against an offer size of 1.71 crore shares, as per data available on the NSE.

Mumbai Gains Majority of Maharashtra's $1.4B Funding

Mumbai retained its leadership as the top funding hub, with a notable share of 64 per cent, while the ecosystem also witnessed two IPOs and the creation of one unicorn during the period.