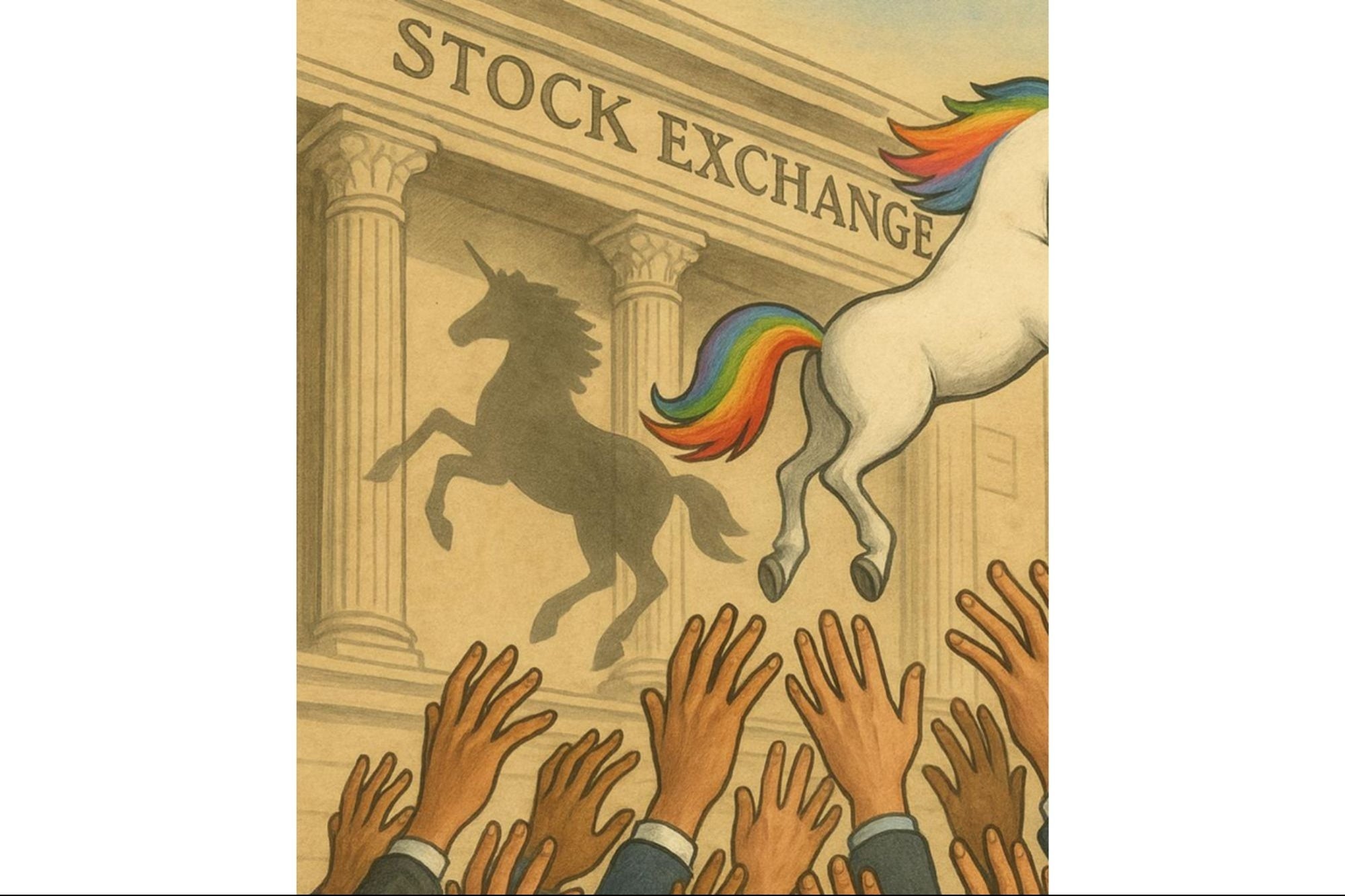

Hunting the Next Pre‑IPO Unicorn: Why Everyone Is Trying to Catch the World TradeX Rocket Before It Leaves the Station Among the slate of highly anticipated pre-IPO unicorns—Figma, CoreWeave, Dexterity, Pony.ai, and Linqto—one name stands apart, largely because almost no one outside of deep-pocketed insiders had even heard of it until recently: World TradeX.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

In 2025, Wall Street is waking up to a new reality: the unicorn class is back, and it's bolder, broader, and bigger than ever. After a quiet few years dominated by inflation anxiety, interest rate hikes, and macro volatility, the IPO window is finally creaking open—and investors are jockeying for position to board the next rocket ship before liftoff.

Among the slate of highly anticipated pre-IPO unicorns—Figma, CoreWeave, Dexterity, Pony.ai, and Linqto—one name stands apart, largely because almost no one outside of deep-pocketed insiders had even heard of it until recently: World TradeX.

A mysterious giant that has been building quietly for nearly eight years, World TradeX is not just another tech unicorn. It's a category‑defining, economy‑reshaping platform—likened by some early analysts to Uber, eBay, Tinder, and Apple for its disruptive force, but on a global trade scale. It aims to do for commodities and cross‑border agriculture what those companies did for mobility, dating, marketplaces, and consumer tech—only this time, the stakes are existential, the mission is humanitarian, and the market size is unprecedented.

The Top Pre‑IPO Unicorns of 2025—And the Company No One Saw Coming

Before we zero in on World TradeX, here's a look at some of the major IPO contenders making headlines this year:

1. Figma – Design's Flagship Unicorn

Backed by the world's top venture capitalists, Figma is a collaborative design platform reportedly aiming for a valuation north of $14 billion in its IPO. With profitability in Q1 2025 and revenue approaching a quarter billion annually, Figma leads the creative tools renaissance—and investors see it as the Adobe challenger with staying power.

2. CoreWeave – Infrastructure for the AI Era

The AI boom has supercharged demand for compute infrastructure, and CoreWeave sits at the intersection of this tidal wave. With a $35 billion valuation and multibillion-dollar contracts with OpenAI, it's the rare infrastructure play that could rival cloud giants—and its IPO is already one of the largest of the year.

3. Dexterity – Industrial Robotics, Human-Level Agility

Valued at $1.65 billion, Dexterity builds "superhuman" robots for warehousing and logistics. In a world scrambling to fill labor gaps while scaling efficiency, Dexterity's IPO is being closely watched as a benchmark for hardware and AI convergence.

4. Pony.ai – The Autonomous Driving Pioneer

China-U.S. autonomous vehicle leader Pony.ai went public via a dual listing strategy—Nasdaq in 2024, and a Hong Kong follow-up planned in 2025. Its technology is battle-tested, but regulatory friction remains a challenge.

5. Linqto – Pre-IPO Access for the Masses

Linqto has built a platform that lets retail investors access unicorn shares before they IPO. Now, ironically, it's prepping its own $700 million public debut. If successful, it will validate the thesis that the secondary markets are becoming the new primary.

World TradeX: A Different Beast Altogether

Amid these high-profile contenders, World TradeX doesn't just stand out—it rewrites the entire playbook.

While others have incrementally improved existing sectors, World TradeX has quietly created an entirely new category. It is the first unified platform for global commodity trading, logistics integration, real-time settlement, farm-to-global-market authentication, and blockchain-powered remittance for producers in developing economies. No other company in the world combines all of these under one roof.

"This is not just a unicorn," one early investor told us under condition of anonymity. "It's the railroad, the train, and the ticket counter—for an entirely new economy."

For eight years, the company operated under the radar, refining its tech infrastructure, negotiating with global trade ministries, and onboarding farmers, producers, and governments from Latin America to Africa. Now, just months before its IPO, insiders believe it could be valued well over $200 billion—possibly the largest IPO of the year and among the most transformative in the last decade.

Like Uber, Tinder, eBay… and Then Some

It's not hyperbole to say World TradeX may do for agriculture and global trade what Uber did for transportation—break the cartel, democratize access, and inject real-time efficiency into an archaic industry.

- Like Uber, it bypasses middlemen and offers direct access—from farmer to buyer.

- Like eBay, it creates a trusted, verified, global two-sided marketplace.

- Like Tinder, it uses algorithmic matching to pair buyers and sellers across continents with intuitive simplicity.

- Like Apple, it marries design, platform integration, and user experience into a seamless, trusted ecosystem.

But the stakes here are far greater. World TradeX isn't just about selling corn or coffee. It's about empowering smallholder farmers, mitigating food insecurity, lowering global emissions via route optimization, and bringing AI-driven financial identity to the underserved billions through its fintech arm, PayX.

This is no app. This is infrastructure for the future of food, finance, and supply chains.

A Market with No Real Competition

Another reason why investors are salivating: there is no other train leaving the station.

Where other unicorns compete in crowded sectors—AI infrastructure, fintech apps, autonomous cars—World TradeX is the only major player in its specific niche. It has first-mover advantage on a global scale, with governments, producers, and buyers already integrated. The app reportedly includes FieldX, a labor platform that digitizes H2A/H2B visa hiring for U.S. farm labor, and PayX, which integrates crypto settlement, compliance, global remittances, and UN-grade biometric identity.

"Everyone's talking about AI. World TradeX is using AI to solve real, tangible, planetary-scale problems. This is agriculture meets fintech meets ESG—on blockchain," says an analyst at JP Morgan familiar with the IPO roadmap.

Of Course, the Challenges Are Real

No unicorn soars without turbulence. World TradeX will face the same scrutiny as its peers—and perhaps more, given its global ambitions.

- Regulatory complexity: Trade laws, customs protocols, data privacy, and biometric compliance vary by region.

- IPO readiness: With no previous media footprint, it must educate the public market rapidly—and clearly.

- Scalability pressure: As investor attention pours in, delivery must match the hype.

- Skepticism: Investors burned by WeWork and other "world-changing" startups will demand financial transparency and execution.

But the company appears ready. Early reports suggest it has built a "shadow army" of legal, financial, and compliance experts to ensure a bulletproof IPO. The founder remains mostly out of the public eye, but internal sources describe him as a mission-obsessed operator, not a showman—a quality investors may now prefer.

Final Word: The One to Watch

In a year filled with buzzy IPOs, World TradeX is the quiet giant, now stepping forward to claim its spot. It may have started as a whisper, but it's quickly becoming the shout investors can't ignore.

If its infrastructure, mission, and execution align, this could be the defining IPO not just of 2025—but of the next economic era.

"You don't get many chances like this," said one fund manager. "Every decade or so, one company steps forward that's not just big—it's inevitable. This might be that company."

Catching a unicorn is hard. Catching a World TradeX may be harder still—because it may not be a unicorn at all. It may be the engine of a new economic model, and the only train that matters.