India Unveils a New Simplified Two-Tier GST Regime: Check What Gets Cheaper and Expensive The new regime now includes a simplified two slabs at 5% and 18%.

By Kul Bhushan

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

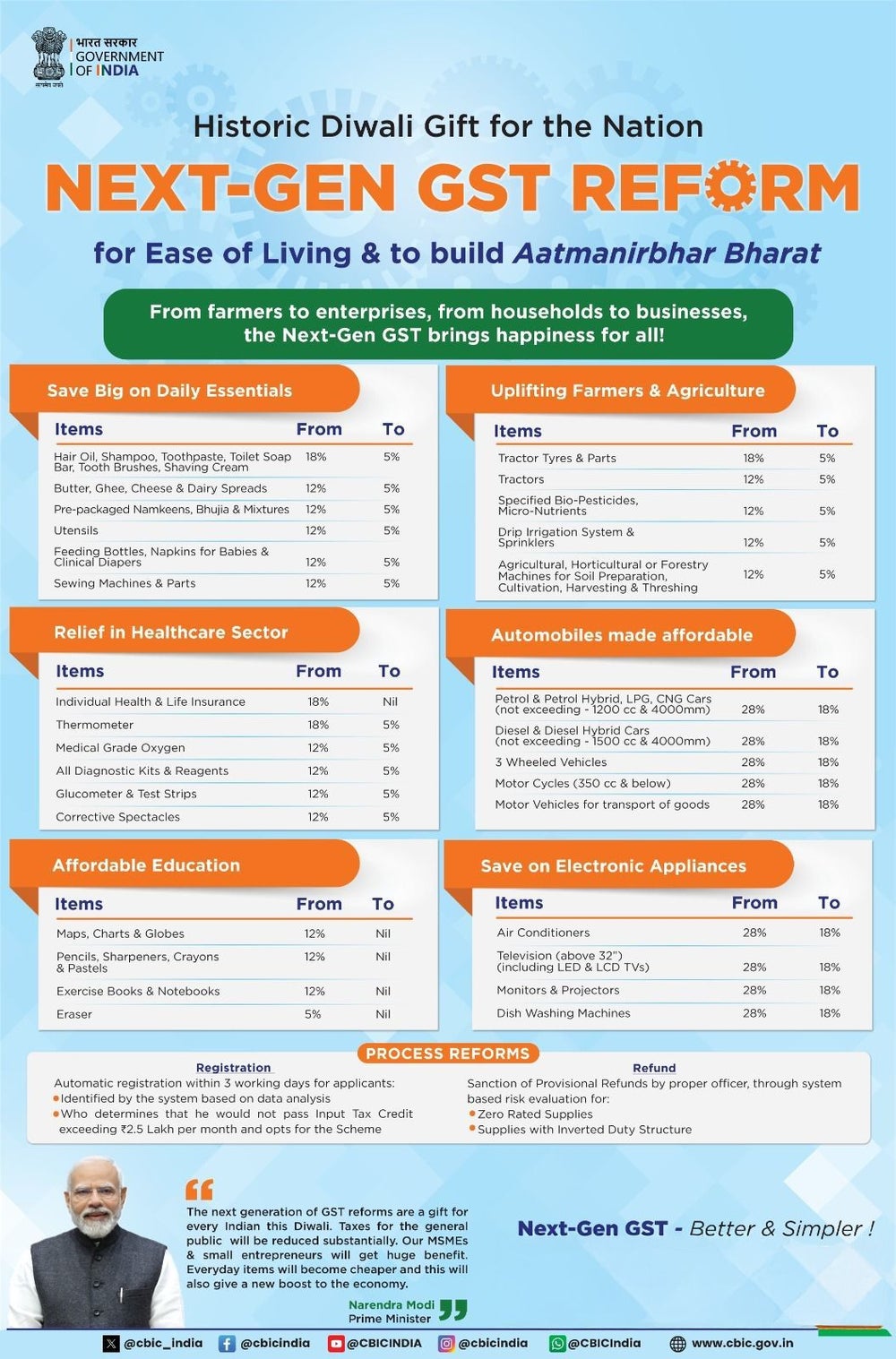

The 56th Meeting of the GST Council, held at New Delhi on Wednesday, proposed a major indirect tax overhaul, restructuring the current regime into a simpler two-rate system. The revised rates will come into effect on September 22, 2025.

India's current four-tier system features tax slabs of 5%, 12%, and 28%. The new regime now includes a simplified two slabs at 5% and 18%. There is also a special 40% slab for select items and services.

Apart from revising the slabs, the GST council has also lowered taxes on a variety of items to zero, as well as moving some items and services to the lower-tier of the slab.

The radical changes in tax slabs were first hinted at by Prime Minister Narendra Modi during his Independence Day speech.

Hailing the move, Modi said, "... Glad to state that @GST_Council, comprising the Union and the States, has collectively agreed to the proposals submitted by the Union Government on GST rate cuts & reforms, which will benefit the common man, farmers, MSMEs, middle-class, women and youth…"

"The wide ranging reforms will improve lives of our citizens and ensure ease of doing business for all, especially small traders and businesses," he added.

Union Finance Minister Nirmala Sitharaman on late Wednesday disclosed that the decisions regarding the GST revision were made unanimously, and that no state had raised disagreement.

Here are some of the key things that will get cheaper

- Common man items such as, hair oil, toilet soap bars, shampoos, toothbrushes, toothpaste, Bicycles, Tableware, kitchenware, other household articles, et al will now attract 5% tax, reduction from 12% and 18%

- Ultra-High Temperature (UHT) milk, Prepackaged and labelled chena or paneer; All the Indian Breads will see NIL rates (Chapati or roti, paratha, parotta, etc) now have nil taxes.

- All of the food items such as packaged namkeens, Bhujia, Sauces, Pasta, Instant Noodles, Chocolates, Coffee, Preserved Meat, Cornflakes, Butter, Ghee, etc. now attract 5% tax.

- Agricultural goods, such as tractors, agricultural, horticultural or forestry machinery for soil preparation or cultivation, harvesting or threshing machinery, including straw or fodder balers, grass or hay mowers, composting machines etc now will have 5% tax.

- GST has been revised from 12% to nil on 33 lifesaving drugs and medicines and from 5% to NIL on 3 lifesaving drugs & medicines used for treatment of cancer, rare diseases and other severe chronic diseases. Tax on all other drugs and medicines are now down to 5% from 12%. Various medical apparatus and devices used for medical, surgical, dental or veterinary usage or for physical or chemical analysis will now be levied 5% tax instead of 18%. Similarly, for medical equipment and supplies devices such as wadding gauze, bandages, diagnostic kits and reagents, blood glucose monitoring system (Glucometer) medical devices, etc GST has been revised from 12% to 5%.

- Small Cars and Motorcycles equal to or below 350cc will get cheaper with now 18% of GST from 28%. Buses, trucks, ambulances etc will now have 18% GST.

- The council has proposed reduction of GST from 12% to 5% on renewable energy devices and parts for their manufacture

- GST has been revised from 12% to 5% on "Hotel Accommodation" services having value less than or equal to Rs. 7,500 per unit per day or equivalent.

- There's also a reduction of GST from 18% to 5% on beauty and physical well-being services used by common man including services of gyms, salons, barbers, yoga centres, etc.

What gets more expensive

What gets more expensive

- There will be 40% GST on soft drinks, colas, fruit-based aerated drinks, and all carbonated beverages will now attract. These items earlier attracted up to 28% GST.

- Energy drinks and caffeinated beverages now come under the 40% tax slab.

- Large cars with petrol petrol engines above 1200cc or diesel engines above 1500cc and longer than 4,000 mm, along with motorcycles above 350cc, racing cars, yachts, and personal-use aircraft will also face 40% GST.

- Items such as tobacco, cigarettes and gutka will also get expensive.

Note this is not a comprehensive list. To learn more about particular items and their revised GST rates, visit the official website.

Reactions

"Lower GST rates will be positive for growth in the second half of the year and FY27, besides improving operational efficiency and expanding the size of the formal economy. Higher elasticity of demand for low-cost FMCG products and durables is likely to make the tax cuts consumption-accretive, with these concessions to provide a one-time boost to growth. Factoring in the likelihood of a strong 7% plus growth likely in first half of FY26, we had revised up our forecast here. A durable improvement in demand would thereafter return to employment and income prospects," Radhika Rao, Executive Director and Senior Economist at DBS Bank said in a statement.

"The net fiscal implication is expected to be the tune of INR480bn (0.13% of GDP), after accounting for INR 930bn revenue loss but INR450bn is expected to be collected on sin/ luxury items. With the recent sovereign rating upgrade, we don't expect any compromise on the fiscal deficit target. GST cuts would be disinflationary, partly countered by downward rigidity in prices/mark-ups to preserve margins. Pre-emptively, the government had called on suppliers not to increase prices ahead of the change. While watching the disinflationary impact, we maintain the inflation forecast for FY26, with pass-through likely to be evident in the tail end of the year and positive for FY27 (DBSf 4.3%)," she added.

Gopal Mundhra, Partner at Economic Laws Practice, however, cautioned that accumulation of credit on account of the input services could be a concern for the stakeholders.

"The accumulation of credit on account of the input services (procured @18%) would be an area of concern, given that the textile sector functions on a very thin margin..

There is nothing in the press release indicating any relief on that account.

Currently, the formula prescribed under the law for the computation of refund in case of inverted rate structure does not capture input services.. Further, it has not been clarified that the goods earlier procured under higher GST rate, if sold at lower rate of GST, would be eligible for refund under Inverted rate structure... Such clarification, if issued, would grant immense relief, at least in respect of the inventory already in circulation…," Mundhra explained.

"We welcome the Government's landmark NextGen GST reforms, which reflect Hon'ble PM Shri Narendra Modi ji's vision of ease of living and ease of doing business. By lowering input costs for farmers, simplifying compliance for MSMEs, and enabling small sellers, artisans/weavers and smallholder farmers to seamlessly join e-commerce across states, these reforms will further strengthen India's growth engine," said Rajneesh Kumar, Chief Corporate Affairs Officer, Flipkart Group.

"Timely implementation of these reforms ahead of the upcoming festival season will surely give a huge boost to consumption across categories, widen market access, and accelerate our collective journey towards a Viksit Bharat," Kumar added.