Anyone Can Try the Simple Strategy That One Billionaire Investor Used to Make His First Million Dollars Tax-Free Peter Thiel did it, famously, and you can too.

This story appears in the May 2024 issue of Entrepreneur. Subscribe »

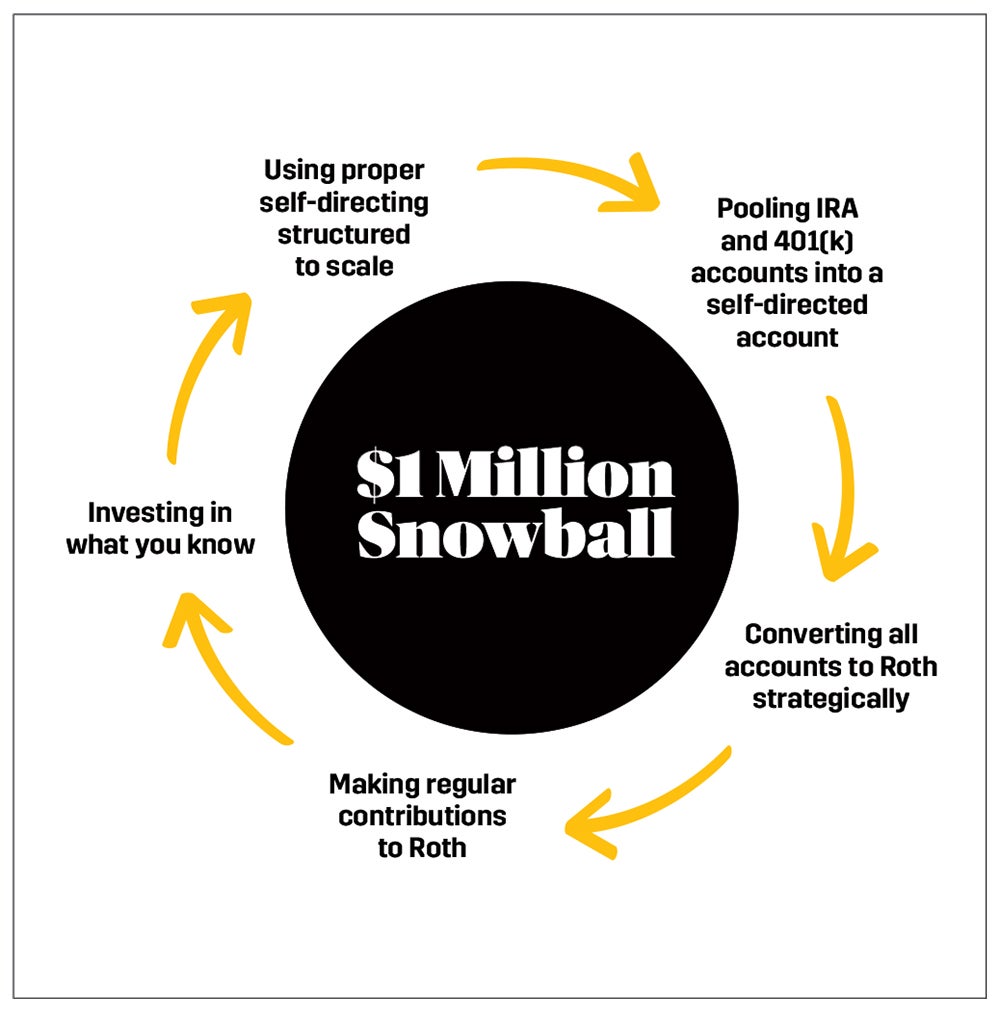

Yes, you can make a million — and more — without paying taxes on it. The wealthy do it every day, and the formula is simple: Take a business or investment idea that's separate from your "day job," combine it with a Roth IRA structure, give it a little time and sunshine, and voilà!

PayPal cofounder Peter Thiel famously did this, according to ProPublica. He turned a $2,000 Roth into $5 billion, by using his Roth to fund his investment in PayPal, which grew astronomically. He never had to pay taxes on the $5 billion because it was generated from that one little $2,000 Roth (that he'd already paid taxes on when he was contributing to it). Thiel used his Roth profits to buy more shares of other startups at low prices with huge growth opportunities, and the rest is history.

So how do you do something like that? Here's a step-by-step guide.

Step 1: Pool your accounts.

Create a spreadsheet of all your IRA accounts, with account numbers and estimated balances. As you do this, open the proper self-directed IRA accounts based on the types of retirement funds you're pulling together. (You'll want a trained eye on this, so ask your accountant.) Then transfer the chosen accounts tax-free and penalty-free to the new self-directed accounts.

Step 2: Convert the money.

If you have any traditional IRA or 401(k) money, convert your funds into a Roth position as soon as possible. Yes, you'll pay some tax, but no penalties — and you'll have frozen the value for tax purposes. You'll never pay tax again on the future growth and value you create.

For example, say you expect a startup or real estate deal to have a significant bounce in future value. Converting the traditional IRA to Roth now, at a far lower value, allows all that future wealth to be tax-free. (Again, consult a professional as you do this.)

Related: 20 Signs You're Destined to Become a Millionaire

Step 3: Feed the machine.

Don't worry about making a huge upfront investment. Just set up regular contributions to your Roth accounts. For example, a 30-year-old who starts contributing $500 a month into their Roth, at a conservative 8% annual return, will have $1M at age 65 tax-free!

Perhaps you've heard that you can't contribute to a Roth if you make too much money. That's false. You can always contribute to a Roth at any age or income level.

Step 4: Invest in what you know.

Here's the real meat of this tax strategy: Your Roth isn't relegated to stocks, bonds, mutual funds, and ETFs — which means you can also invest in "alternative investments," just like the wealthy do.

What's that? It's any business (minus some limitations related to family members and personal ownership) that you think is worth investing in. You can invest your Roth in a startup, for example. If you have unique industry knowledge, or a strategic advantage with an undiscovered business opportunity, that's your secret weapon inside your Roth.

Related: Want Taxes to Be Easy? Work on Them Year Round, Not Last Minute.

Step 5: Structure it properly.

The Roth can be structured to create even more incredible benefits. The LLC is a powerful tool when combined with the Roth account, for example.

Many investors don't realize they can combine multiple retirement accounts, including other family members' Roth accounts, all into one LLC for more buying power and leverage. In fact, investors can combine their own personal funds with their Roth in a properly structured LLC.

By using the "IRA/LLC investment structure," self-directed IRA investors can have signing control of the LLC and even serve as manager without pay for administrative duties. This in turn makes it easier for investors to begin projects, sign contracts, access the checking account, and more quickly fund transactions.

Again, consult a professional for all of this — it's a proven strategy, but requires deep knowledge of the rules. And remember that Rome wasn't built in a day. The Roth IRA account is not a get-rich-quick scheme. It is a way to grow generational wealth and enable you to live the life you hope to in the future.