Ziffi Chess Raises USD 5 Mn in Series A Round Led by Tanglin Venture Partners The round was led by Tanglin Venture Partners with participation from existing investors India Quotient, DeVC and others.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

Ziffi Chess, a startup that offers a fast-paced two-minute chess format, has raised INR 44.2 crore (about USD 5 million) in its Series A funding round. The round was led by Tanglin Venture Partners with participation from existing investors India Quotient, DeVC and others.

Regulatory filings with the Registrar of Companies show that the board of Ziffi Chess issued 3,792 Series A compulsorily convertible preference shares and one equity share at a price of INR 1,16,583 each to secure the investment.

Tanglin Venture Partners contributed the largest share at INR 34.4 crore, while India Quotient invested INR 8.6 crore through its IQ Alpha IV fund. Additional contributions came from DeVC, Symphysis LSV LLP and Rohan Nayak.

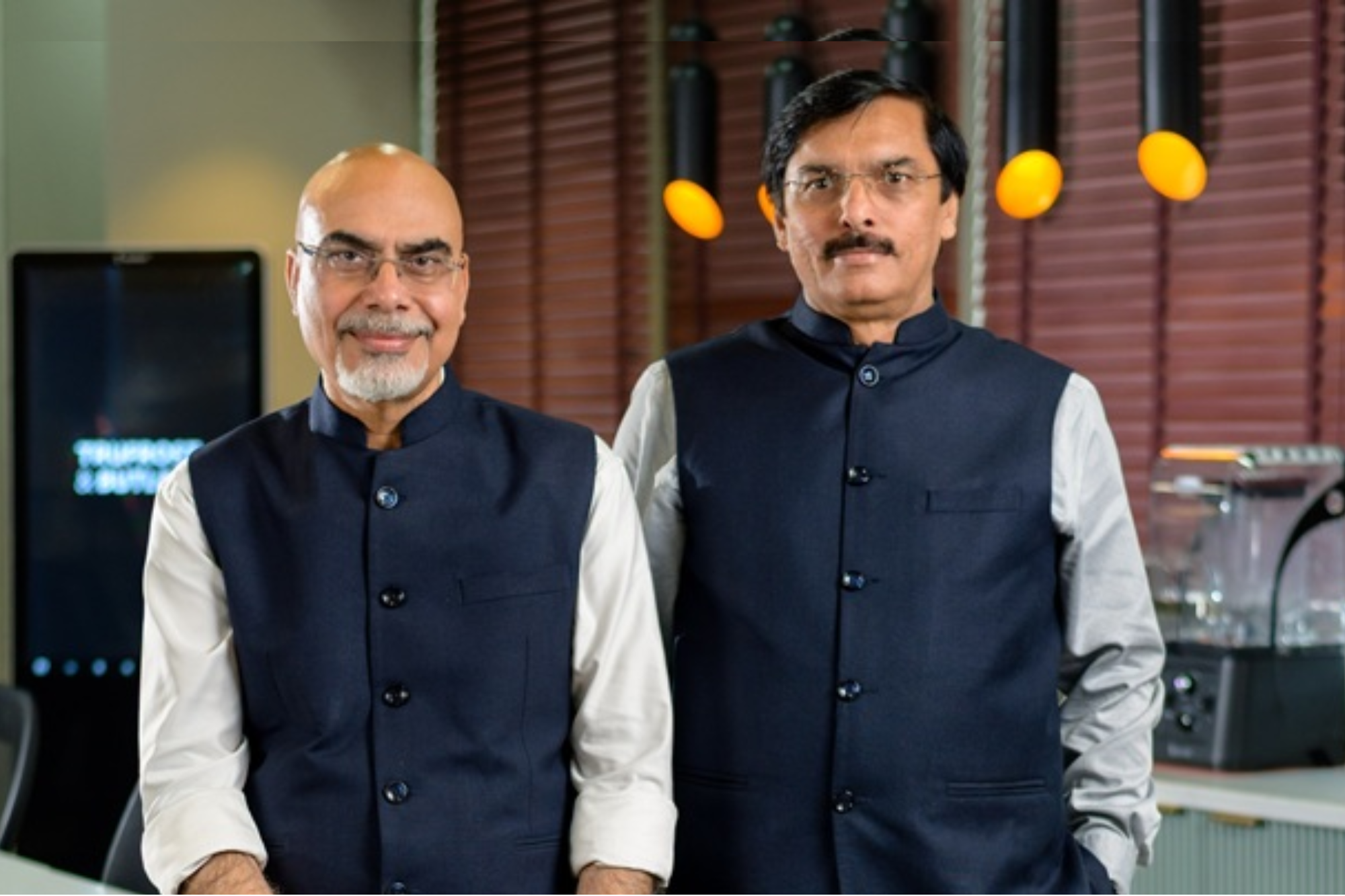

Following the allotment, Tanglin Venture Partners has a 16.67 percent stake in the company, while India Quotient holds 15.2 percent. The two co-founders, Akshat Bansal and Aditya Dubey, continue to control a combined 53.54 percent share. Bansal and Dubey, both alumni of the Indian Institute of Technology Bombay, founded the company in 2023 after earlier working together on the quick-commerce pivot at Blinkit.

Ziffi Chess first raised about INR 7.3 crore in a seed round across two tranches from India Quotient, DeVC and several angel investors, though the company did not disclose details of either the seed or Series A rounds publicly until now. Together, the two rounds have brought in close to USD 6 million.

The platform introduces a condensed version of chess, structured around a two-minute, six-move format. Matches can be played for free, and tournaments feature a prize pool of INR 350.

Initially, the firm charged players an entry fee starting from INR 10, but after the government introduced restrictions on real-money gaming, Ziffi Chess shifted to a free-to-play model.

Despite rapid user adoption, the company is still in its early financial stages. For FY24, its first year of operations, Ziffi Chess reported operating revenue of INR 1.5 lakh and expenses of INR 87.65 lakh, leading to a net loss of INR 86 lakh.

Tanglin Venture Partners, which spearheaded the investment, was founded by former Tiger Global executive Ravi Venkatesh and is in the process of raising its third fund with a USD 250 million target corpus.