Extraordinary Tale of Seiji Kawajiri: Man Dedicated to People, Art, And Culture With over 180 innovative ventures backed, including in India, his portfolio spans fintech firms, logistics startups, renewable energy projects, blockchain-based platforms, and hospitality ventures that combine cultural authenticity with global standards

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

It's hard to put a single label on Seiji kawajiri. Is he an entrepreneur, an investor, or an art connoisseur? perhaps all of them. Yet, there's a lot more to him than meets the eye.

With over 180 innovative ventures backed, including several in India, and investments hovering above USD 300 million, one may assume Kawajiri comes from a life of privilege. However, his journey did not begin with such an advantage. And his secret sauce is a mantra that will instantly resonate with everyone – you create opportunities, not something you inherit. "I grew up in a modest household in Japan, surrounded by parents who instilled in me the values of perseverance, humility, and an almost stubborn sense of curiosity," recalls Kawajiri, who today owns 100 per cent of Samurai Securities Co., Ltd., a licensed financial institution in Japan.

He also leads Kawajiri Investment Holdings PTE. LTD., his wholly owned family office headquartered in Singapore. "As a child, I was fascinated not only by books but also by people. How communities worked, why some businesses thrived, and why others failed. I did not come from wealth, so I had to learn early on that opportunity was something you create, not something you inherit." This philosophy transformed him into a billionaire entrepreneur, investor, philanthropist, and cultural patron. Today, Kawajiri is known across Asia and beyond for his investments and philanthropy.

Lesson From His First Venture

At 36, he sold his first company, a financial services venture that sought to democratise access to investment tools for everyday people. "That company was founded with little more than a laptop and a restless belief in possibility," he says. "At the time, fintech was still in its infancy in Asia, and we took bold risks. It was far from smooth sailing; there were moments when we nearly collapsed, but it was precisely those trials that forged my resilience.

When we eventually exited, it was not just a financial victory but proof that even someone from ordinary beginnings could build something extraordinary." He says selling the company was not just a business transaction but a life-changing moment. "I believe selling my first company taught me that circulation creates more value than possession. Letting go opened doors to new opportunities and relationships. That experience shaped my current investment philosophy."

Building His Legacy And Investment Philosophy

Kawajiri believes Samurai Securities was born out of a conviction that Asia needed a bridge between traditional capital markets and a new generation of entrepreneurs who were eager to build but lacked access to sophisticated funding. "We positioned ourselves as both a financial partner and a cultural translator, helping global investors understand Asia's unique context while giving local founders the credibility and capital to grow," he explains.

Kawajiri Investment Holdings, meanwhile, serves as his broader global platform. "From Japan to India to Singapore and beyond, we focus on high-impact opportunities where capital can accelerate not just profits, but transformation. In India, for instance, we have invested in fintech firms that are leapfrogging traditional banking infrastructure. In Singapore, we back asset management and real estate ventures that align with long-term urban planning trends."

His investment philosophy is simple: invest where innovation meets necessity and where the ripple effect benefits entire communities. "I am most drawn to sectors where technology meets human needs, including fintech, healthtech, sustainable real estate, and digital infrastructure," Kawajiri says. When investing, he applies three filters: scalability, sustainability, and societal value. "If an idea can impact millions, sustain itself economically, and improve lives in a measurable way, then it has my attention."

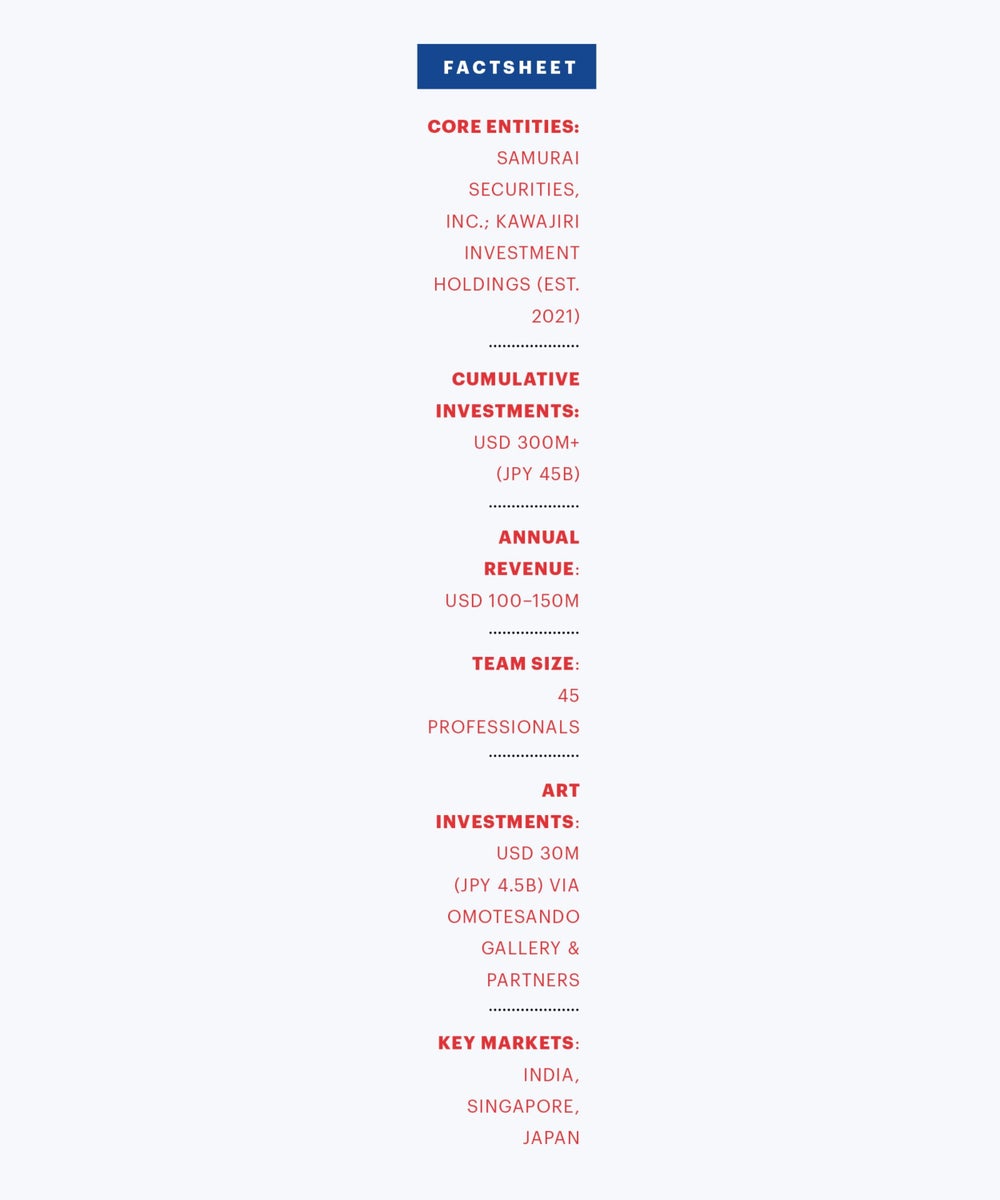

In India in particular, his portfolio spans fintech firms enabling digital lending in rural areas, agritech platforms helping farmers secure fair pricing, logistics startups streamlining supply chains, renewable energy projects, blockchain-based platforms, and hospitality ventures that combine cultural authenticity with global standards. "Our cumulative investments exceed USD 300 million, and our consolidated annual revenue ranges between USD 100 million and 150 million. But profits are not the end goal. Much of it is reinvested into new ventures and long-term asset growth," he explains.

Facing The Storms

Kawajiri is quick to remind aspiring entrepreneurs that success is not a straight road. "Every entrepreneur encounters storms," he reflects. "For me, the greatest challenges were not simply financial or operational, but psychological. There were seasons when investors withdrew, when regulators shifted the rules overnight, and when trusted partners failed to deliver. In those moments, it was tempting to surrender to fear." But he believes clarity of vision saved him. "I had to constantly remind myself: Why am I building this? Who am I serving? Once you anchor to that deeper mission, challenges become temporary obstacles rather than permanent defeats. I also learned to surround myself with people who were smarter than I, people who challenged my assumptions and forced me to evolve. That, more than anything, allowed me to navigate turbulence and emerge stronger."

Philanthropy: Education as The Highest ROI

Kawajiri's philanthropy is deeply personal. He founded the Kawajiri Foundation, which provides scholarships to academically exceptional but financially disadvantaged students, inspired by his own challenges affording higher education. He firmly believes, education expands life's options. "Even without wealth, knowledge and skills can transform one's future. I see education as the highest return investment one can make."

"My educational journey was not defined by a single prestigious institution but by a mosaic of experiences, learning from mentors, international exchanges, and later, immersing myself in both Eastern and Western business philosophies," he explains. "From my own experience of giving up on going to university, I wanted to create an environment where my children would not give up on going to school for financial reasons. In addition, we launched this foundation with the hope that by supporting students, young people who will create Japan in the future can grow and contribute to a better society. We will continue to support students with the aim of creating an environment where they can receive education equally."

Art, Culture, And Community

Beyond finance and philanthropy, Kawajiri is passionate about supporting art and culture. He has invested approximately USD 30 million into the sector, working with galleries, curators, and artist collectives across Japan, Singapore, and Hong Kong. "KIWA was born from my desire to create harmony between the old and the new," he says of the Light Tea Room KIWA, donated to Kyoto City's East Plaza.

"Art invites people to rediscover a city's charm. Immersive art in Kyoto has inspired not only visitors, but also locals to take renewed pride in their city." He is also a supporter of the internationally acclaimed Dandelion Project by artist Ryotaro Muramatsu, showcased at the G7 Hiroshima Summit and across 15 locations worldwide. "Art has the power to move people and sometimes shift the atmosphere of society. Projects like the Dandelion Project and The Gallery Harajuku create spaces where culture connects people and inspires new perspectives." For Kawajiri, keeping art relevant is about innovation. "We maintain relevance by updating the project in step with cultural and social changes, and by incorporating participatory events and workshops to keep it connected to today's audience."

Reflecting on the growing investment in the art market, he says, "Yes, absolutely, I believe the art market is booming because people are once again connecting with local art. For a time, art was treated purely as a speculative asset class, something to trade rather than to treasure. But in Asia, particularly post-pandemic, there has been a profound reconnection with heritage, storytelling, and local identity. People are not just buying art; they are rediscovering themselves through it. That emotional connection is what makes the market sustainable rather than cyclical."

Kawajiri is also confident about Asia's role in shaping the global art business. "The future is immense. Asia is not only producing globally recognised temporary artists but is also redefining how art is consumed through digital platforms, NFTs, immersive exhibitions, and cross-disciplinary collaborations. I see a future where art is not confined to galleries, but becomes part of everyday life, shaping urban design, hospitality, and even technology interfaces. For investors, the opportunity is not just in collecting art but in building ecosystems that connect creators, collectors, and communities."

An Author

Kawajiri is also an author. His book, Global Citizen: Seven Rules to Achieve Your Dreams Your Way, sold over 100,000 copies in its first edition. "I believe what resonated most with readers was the human aspect, living beyond titles, borders, or labels. The book's success encouraged more young people to embrace a global perspective, and it deepened my own commitment to letting actions speak louder than words."

Next Bets

When asked about the most promising emerging markets in Asia, Kawajiri highlights regions that are often overlooked by mainstream investors. "South Asia, particularly India, Bangladesh, and Sri Lanka, offers extraordinary potential in fintech, healthtech, and education. Southeast Asia is ripe for sustainable infrastructure, logistics, and green energy. An untouched frontier is the silver economy, solutions for Asia's rapidly aging population."

According to him, another overlooked sector is climate adaptation technologies tools that help communities survive and thrive in the face of environmental challenges. He also believes in the tech race, South Asia can surpass developed countries. "South Asia's advantage lies not only in cost efficiency but also in scale, diversity, and resilience.

Unlike developed countries, which often wrestle with entrenched legacy systems, South Asia can leapfrog directly to advanced technologies. With a young, dynamic workforce and increasing global capital flows, I see the region not just catching up but, in some verticals such as fintech, AI-driven agriculture, and digital education, surpassing traditional leaders within the next decade." His vision for the next decade is equally bold. "I want to leave behind a culture of bold challenge and the spirit of paying it forward. My mission is to create an environment where future generations believe in their own potential and have the courage to take it global."