10 Mistakes to Avoid When Pitching Investors (Infographic) For many entrepreneurs looking to start a business, getting access to capital can be the make-or-break moment to a successful launch.

Opinions expressed by Entrepreneur contributors are their own.

Like it or not, money is the lifeblood of a business. If you are on the hunt for capital and have landed a meeting with an investor, your first impression can either be a deal breaker or money in the bank.

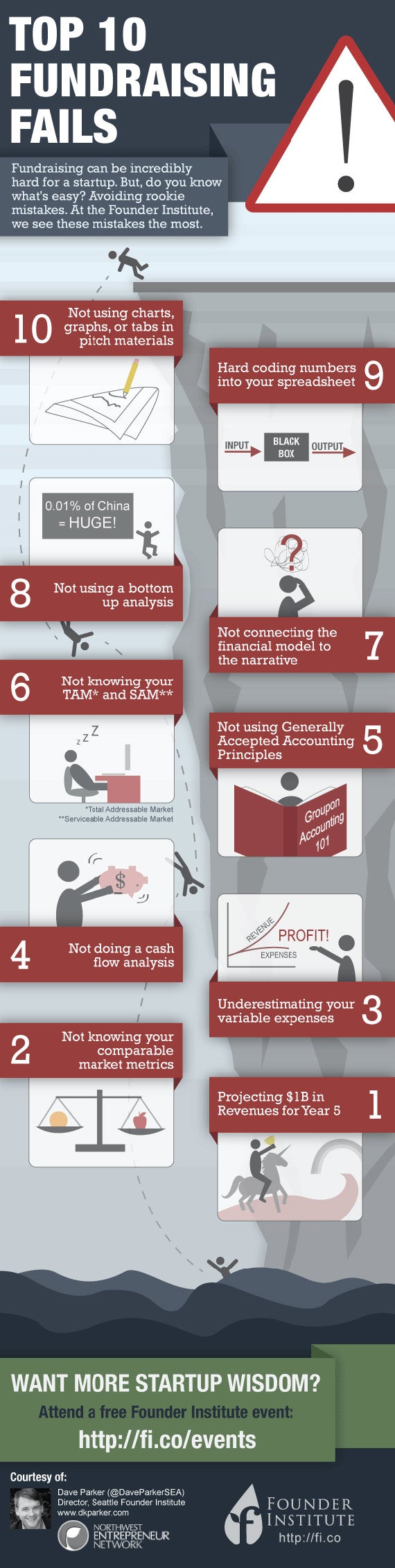

According to Founder Institute, an early-stage startup accelerator in Mountain View, Calif., one of the biggest flubs rookies make in an investor presentation pitch is failing to include charts and graphs. If you aren't sure how to go about making charts and graphs that relate to your financial projections, you can consider hiring a business student or a certified public accountant for a day to help. Also, the institute says, steer clear of promising potential investors that your startup is going to be worth $1 billion by its fifth year. Investors want conservative estimates that they can trust, not pie-in-the-sky guesstimates.

Related: Hunting for Business Ideas? Consider Looking at These 8 Hot Industries

Other tips from the Founder Institute include:

- Avoid a "hard coded" financial spreadsheet in your presentation – that is, don't make your numbers unchangeable in a spreadsheet. Present your information so that investors can play with your various financial inputs to see how your business model will survive in changing conditions.

- Skip what's known as a "top down" financial forecast where you assume that your company will automatically win a percentage of some existing market. Instead, use what's called "bottom up" forecasting, where you base your financial projections on an actual budget: essentially, how many items you are going to sell multiplied by how much each is worth.

- Talk about the size of your total addressable market (TAM), but don't focus on it. For example, if you are creating an iPhone game for women ages 35 and up, the size of the entire gaming industry would be your total addressable market and would be largely irrelevant. Instead, research your serviceable addressable market (SAM), which in this example would be the total market for women over the age of 35.

In the infographic below, Founder Institute offers a list of the 10 rookie pitching mistakes it sees on a regular basis.

Related: Entrepreneurship: Risks You Need to Consider (Infographic)