Sponsored Content | Brand Spotlight Partner What's This?

Going Global, Still Hustling: How This Founder Keeps the Startup Mindset Celebrating its 25th year, Electronic Payments is taking its mission of helping small businesses international.

For Michael Nardy, the last 25 years have been a blur. In the best of ways.

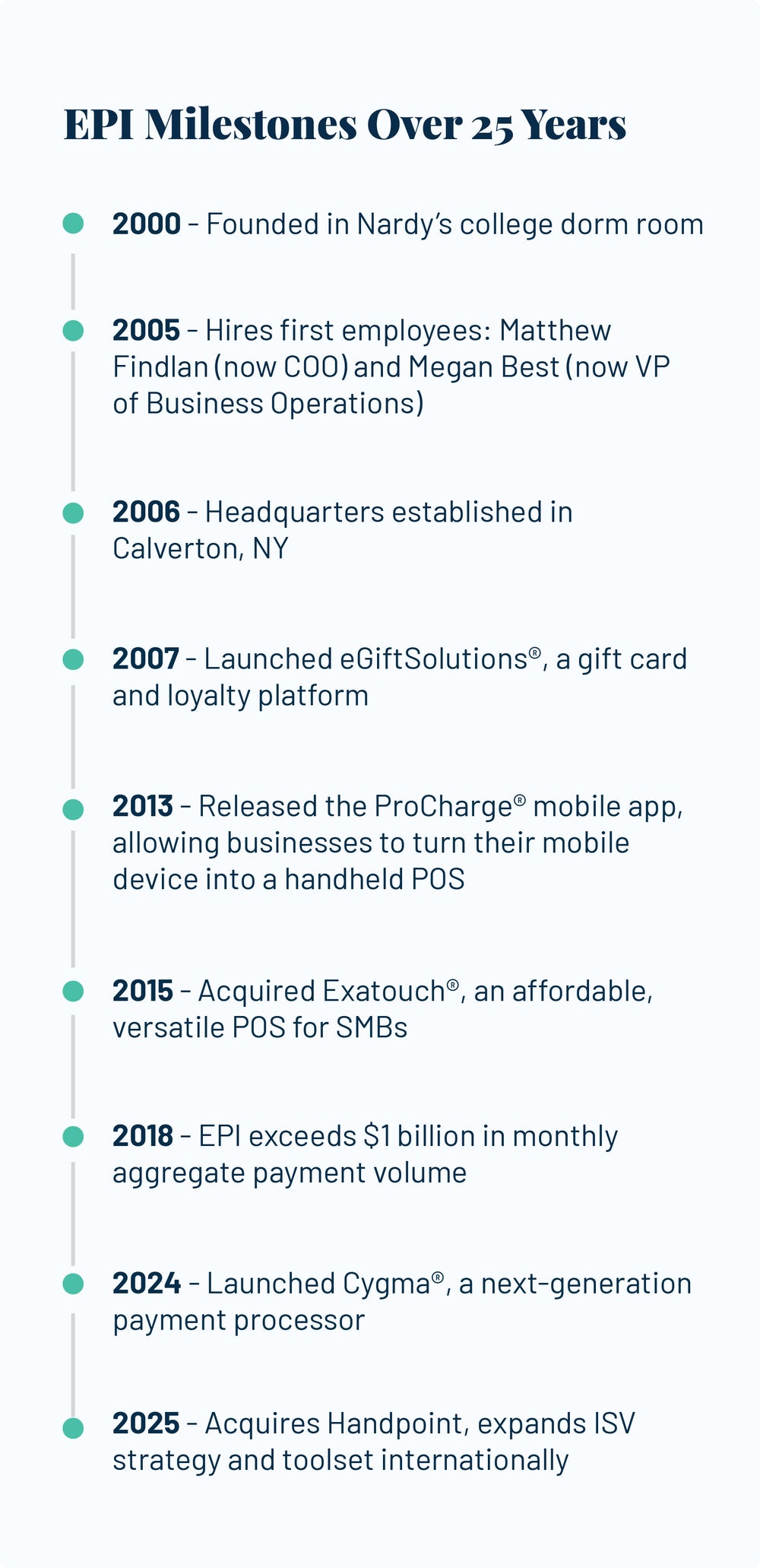

Back in 2000, Nardy was a 19-year-old English major in Boston who happened to have a knack for computers. His interest in technology eventually evolved into a zeal for payments. "The payments industry back in the late 1990s and early 2000s was changing rapidly," Nardy recalls. "I just fell into something that I enjoyed and was really passionate about."

Even at such a young age, Nardy had a vision of helping small- and medium-size businesses (SMBs) grow by creating exceptional payment technologies. From his dorm room, a company called Electronic Payments, Inc. (EPI) was born. Fast forward to today and EPI has grown into a fintech powerhouse with 1,500 national sales partners and 60,000 merchants, processing over $25 billion in annual volume.

As a young college student, Nardy never imagined that he'd still be running that budding tech startup decades later. Now 45 years old, Nardy remains firmly at the helm, overseeing EPI's growth and innovation. "I can't believe it's been 25 years," he says with a laugh.

After all these years, Nardy says he hasn't lost his startup mindset. "I'm not the typical top-down management CEO barking orders," he explains. "If I need to get in the weeds on something, because I've been in the weeds a lot through the years, I'll jump right in.

"To me, that's a startup mentality," he continues. "I don't know if that ever goes away, at least as long as I'm here."

At EPI, Nardy says that type of mindset is contagious. "We have departments with their respective managers and supervisors of course, but everything is linear," he says. "It's a very cooperative, all-hands-on-deck workplace. And that's certainly reminiscent of a startup culture."

Next step: Going global

Last year, EPI launched its wholly owned processor: Cygma®. Built internally, Cygma is a frontend authorization network and backend clearing platform that offers merchants, sales partners, and financial institutions better rates, same-day funding, expanded support, and more. Nardy says Cygma now handles more than $3 billion in annual volume, with substantial accretive volume added every month.

The next step in EPI's path forward is expanding internationally. "We partner with software technology companies and point of sale systems all around the U.S., Canada, the U.S. Virgin Islands, and Puerto Rico," Nardy says. "But what happens, for example, when our partners have a client in Spain? You have to be able to expand beyond these borders."

EPI recently completed the acquisition of Handpoint, an embedded payments platform designed for in-person payments, offering secure, scalable solutions with seamless integration and support for multiple currencies, languages, and regional compliance requirements.

Nardy says the acquisition effectively expands EPI's business into the UK and Europe, and down to South Africa—with the intention of adding more countries in the coming months and years.

"Handpoint integrates with software vendors and point of sale companies and includes everything from embedded payments in, say, a vending machine to handheld POS devices that a server brings to your table at a restaurant," he says. "This adds 18,000 connected devices and $2 billion in volume to our portfolio. … It's a fairly big deal to get done."

Always innovating

Even with its sights set on global opportunities, EPI is constantly experimenting and building new products in-house. The company's latest is called TableTurn®, a POS and order management platform designed specifically for restaurants.

"We wanted to build an Android-based point of sale that is specific to hospitality, namely sit-down restaurants and quick-service restaurants," Nardy explains. TableTurn offers an array of restaurant-specific features such as online ordering; mobile solutions for curbside pickup, delivery, and pay-at-the-table; check splitting; support for cash discounting; and more.

"Restaurants are complicated businesses," Nardy says. "Their products are highly perishable. Their menus change with the seasons. They serve loyal customers, but they often have high staff turnover rates. The right POS system can help make or break the business. With TableTurn, we built something with a ton of features that is also incredibly simple to use."

TableTurn has launched in a handful of restaurants so far, but Nardy envisions a future where restaurants all over the world will leverage its smart, efficient tools. "We're excited and see it expanding pretty quickly over the next few years," he says.

Click here to learn more about Electronic Payments and the innovative solutions it offers.