Between the Lines: OpenAI's Need to Diversify Chip Supply Nvidia has emerged as the biggest gainer from the AI boom in the last couple of years.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

OpenAI is developing its first artificial intelligence chip in partnership with Broadcom, a US-based semiconductor company.

First reported by the Financial Times, OpenAI's first chip will be used for internal purposes rather than being leveraged for external users. The chip should be ready by next year.

The report follows a previous Reuters report, published in February of this year, that OpenAI was finalizing a design for an in-house chip and would send it for fabrication at Taiwan Semiconductor Manufacturing Co.

OpenAI declined to comment on the report.

A strategic ploy

The likes of OpenAI are in constant need to upgrade their infrastructure. This is not just to meet the exponential demand but also to maintain a competitive edge in the market.

OpenAI's ChatGPT has had the first-mover advantage in generative AI, with millions thronging to the platform in a relatively short period of time since its launch. The company also faces competition from typical big tech companies such as Google and Meta, as well as from firms like Perplexity and others.

Already, Google, Amazon, and Meta have developed custom chips to oversee their AI workloads. Unsurprisingly, OpenAI will not want to be left behind in this race either.

Moreover, an in-house chip is said to give OpenAI a strategic advantage in the market when it comes to negotiating with other chip makers. Even though it is yet to be tested in the wild, a successful chip could pave the way for OpenAI to gain more control over the ecosystem, a familiar playbook that Apple deploys for its suite of services and products.

Broadcom's gain amid Nvidia dominance

Broadcom has gained wide attention after it posted strong third-quarter results. It also disclosed that it had bagged a USD 10 billion deal for custom chips with a new customer.

The company is now expecting to go past USD $17.4 billion in revenue for the coming quarter even as it reported a 22% growth in Q3 compared to the same period last year.

It's worth highlighting that Broadcom's market cap has risen to over USD 1.4 trillion, nearly doubling over the last year.

In the earnings call, CEO Hock Tan said, Looking beyond what we're just reporting this quarter, with robust demand from AI, bookings were extremely strong, and our current consolidated backlog for the company hit a record of $110 billion. Q3 semiconductor revenue was $9.2 billion, as year-on-year growth accelerated to 26% year-on-year."

"This accelerated growth was driven by AI semiconductor revenue of $5.2 billion, which was up 63% year-on-year, and extended the trajectory of robust growth to 10 consecutive quarters," he added.

On the other, Nvidia has emerged as the biggest gainer from the AI boom in the last couple of years. Its stocks and market cap both are at an all-time high.

Experts note that Nvidia's strength has been combining hardware with software as the firm . invested early in GPUs and built CUDA, which helped developers access tools to adapt GPUs for deep learning.

"That timing mattered because when AI workloads started to grow, researchers already had a platform to build on. Beyond chips, they built an ecosystem that included libraries, frameworks, and strong partnerships with cloud and enterprise players. This gave customers confidence to adopt their solutions widely. Their approach shows that in AI hardware, success depends not only on powerful processors but also on making the technology accessible for developers and scalable for businesses," Shah said.

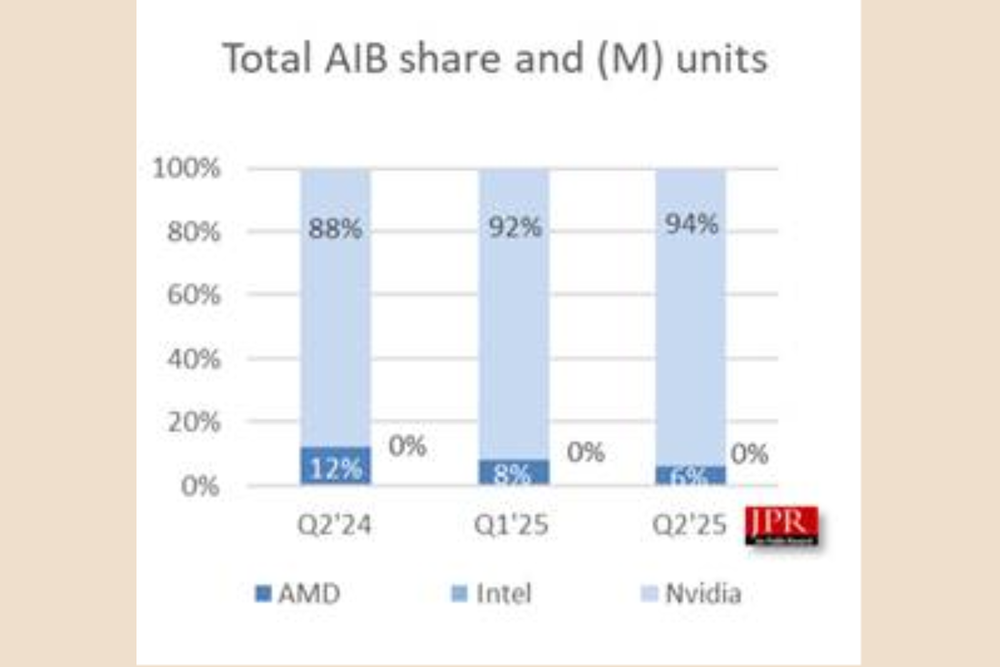

Jon Peddie Research's latest report says that Nvidia owns a whopping 94% of the discrete graphics card market, completely overshadowing rivals AMD and Intel.

<Source: Jon Peddie Research>

"AIB [add-in board] prices dropped for midrange and entry-level, while high-end AIB prices increased, and most retail suppliers ran out of stock. This is very unusual for the second quarter," said Jon Peddie Research president Dr Jon Peddie said in its report. "We think it is a continuation of higher prices expected due to the tariffs and buyers trying to get ahead of that."

Even as Nvidia is topping the charts, it may have its own set of challenges. According to an MLQ analysis, Nvidia's revenues are concentrated on two major customers, which might become a challenge for the firm in the long run. Nvidia's latest filing with the U.S. Securities and Exchange Commission (SEC) reveals these two anonymous customers contributed a cumulative 39% share of its record $46.7 billion revenue in the second quarter of 2025.

"Nvidia has built a strong position, but the AI hardware market is too large for one company alone. Demand is expanding across cloud, edge, and IoT, which creates space for new players, " explained Nikul Shah, co-founder at Indiesemic.

Firms with expertise in custom ASICs, embedded systems, and domain-specific chips will be well placed to compete, Shah further explained.

"We already see global companies investing in AI-focused processors and local firms in India exploring RISC-V and edge computing. The opportunity lies in creating specialized chips that are efficient, scalable, and tailored to industry needs. Over time, the market will diversify and more players will catch up to meet demand, he added.

Can India chip in?

India is now scrambling to join the AI race after the US and China gained a significant lead. The road to this ambitious task begins with the local manufacturing of semiconductors.

So far, the government of India has approved 10 projects in areas of strategic importance, including high-volume fabrication units (Fabs), 3D heterogeneous packaging, compound semiconductors (including Silicon Carbide – SiC), and outsourced semiconductor assembly and test (OSATs)

This is why the fourth edition of SEMICON India 2025 also saw a lot of traction among the government and industry stakeholders.

At the event, Electronics and IT Secretary S. Krishnan revealed that the central government has already committed nearly INR 629 billion (US$7.17 billion)—about 97 percent of the INR 650 billion (US$7.41 billion) earmarked as incentives for semiconductor production under the India Semiconductor Mission.

The remaining funds can accommodate only a few smaller projects. The allocated budget has been set aside for chip production, INR 100 billion (US$1.14 billion) for modernizing the Semiconductor Laboratory in Mohali, Punjab, and INR 10 billion (US$114 million) for the design-linked incentive scheme.

READ: India's Chip Ambition Sets New Benchmark With Semicon

For OpenAI, India is a key market. The company has also shown its serious interest in the country by announcing plans to launch an office in New Delhi.

The company has already begun hiring for senior sales roles as it looks to expand operations beyond its sole India-based employee, Pragya Misra, who leads public policy and partnerships.

India is now ChatGPT's second-largest market by users, with weekly active usage having quadrupled over the past year. Jake Wilczynski, OpenAI's APAC head, highlighted that India is also among the top five developer markets globally and hosts the world's largest student base on ChatGPT.

Given the talent pool of engineers and researchers who are working on chip design, embedded systems, and AI applications combined with the rise of fabless design companies, start-ups, and R&D collaborations with universities, India stands a chance to become a crucial part in the AI chip supply ecosystem.